At the PM forum annual conference last week, I had the pleasure of listening to the keynote speaker Dr Susan Rose talking about how digital channels and AI are reshaping consumer decision-making, loyalty, and expectations in professional services. Some of the key takeaways of a very compelling presentation can be found below.

Compression of decision-making in the internet era:

- Pre-internet decisions for high involvement services (legal, accountancy, tax, consultancy, healthcare) took weeks or months.

- Internet and platforms like Amazon compress decisions to minutes or seconds.

- Compressed processing may reduce the effectiveness of decisions.

- Speed contributes to overconsumption and downstream waste/recycling.

- Markets function poorly when buyers make ineffective decisions.

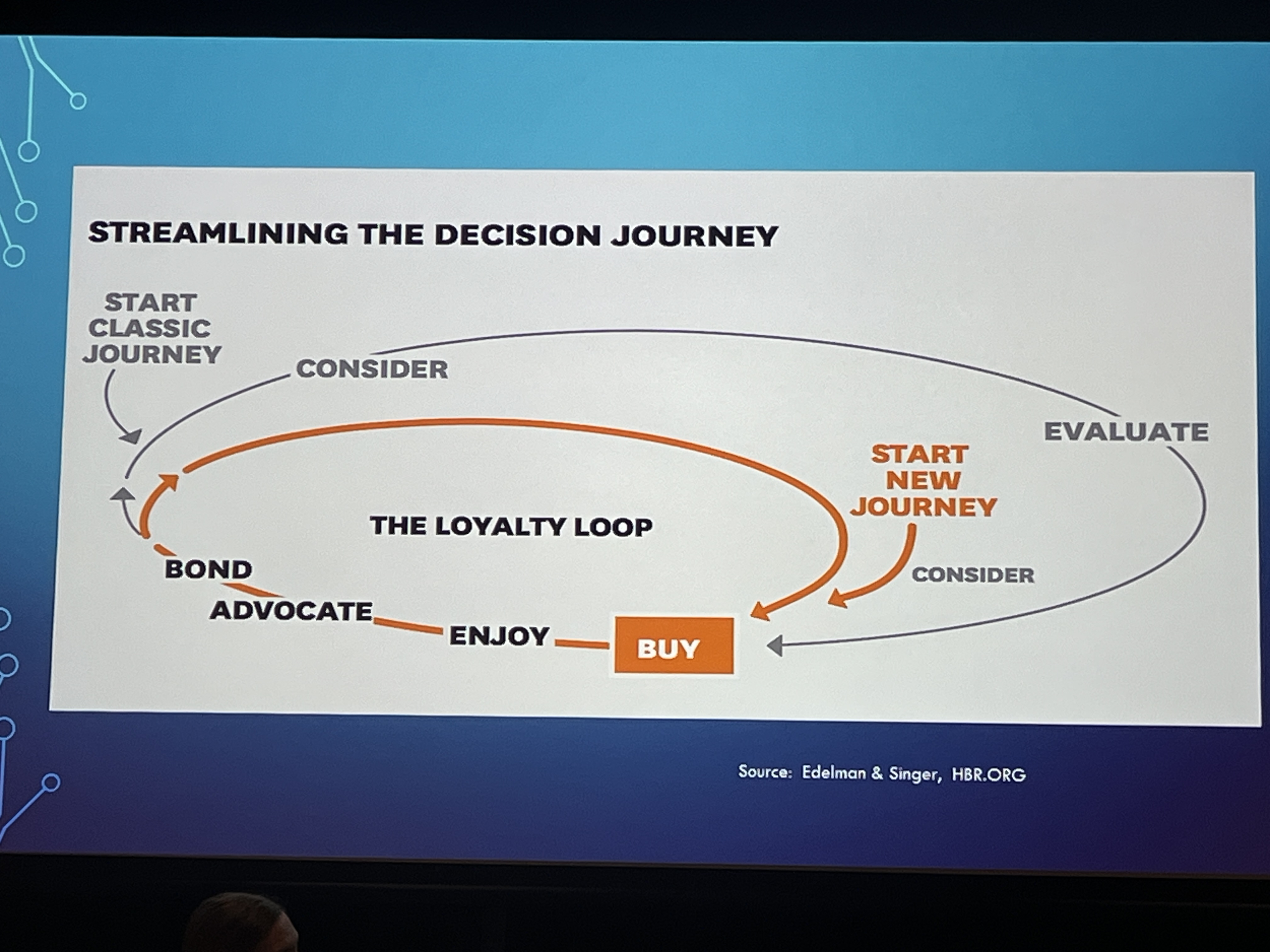

Brand loyalty redefined and the ladder of loyalty:

Loyalty has shifted from emotional attachment to evidence of repeat purchase facilitated by technology. True loyalty is better indicated by advocacy and bonding through positive experiences rather than mere repeat transactions.

- Repeat purchase is often enabled by technology rather than emotional

- Subscription and ease of payment can mask a lack of genuine engagement.

- The desired outcome is advocacy via a ladder of loyalty, moving beyond a mere customer to an advocate.

- Professional services rely on relationship-based loyalty for long-term retention.

Digital-first engagement and transactional relationships:

Technology is now the primary entry point to firms and increasingly the delivery channel. The banking sector is a great example whereby digitalisation has shifted relationships to being solely transactional based. This has meant that online efficiency is the only differentiator and challenger brands like Monzo and Starling have gained market share.

- Digital-first for information and service delivery.

- Bank relationships moved from branch-based to app-based, reducing personalised touch.

- Differentiation now hinges on system efficiency.

- Challengers exploit limited differentiation among incumbents

Rise of digital platforms and rapid adoption cycles:

Platforms in the market are already delivering legal, accounting and consulting tasks online. Segments of the market will adopt them and this can lead to a reshaping of the industry in as little as 4-5 years.

- Existing platforms offer professional services tasks.

- Scepticism about competition should be tempered by rapid adoption dynamics.

- The coaching industry reversed delivery modes after COVID: pre-COVID 90% face-to-face; after COVID about 85% online.

- Adoption windows can be as short as 4-5 years, significantly changing market norms.

Evolving service expectations: speed, responsiveness, transparency:

Consumers now expect rapid responses with transparency and information. Professional services can often lag, risking misalignment with expectations including ‘always on’ access and service timing aligned to the customers needs.

- Expectation of 24-hour response contrasts with multi-week waits from professional services firms.

- Desire to access services at any time, even 2 AM, via online delivery (‘always on’).

- Transparency of information pre-contact is expected, with clients wanting to know everything before making contact.

- Service timing should prioritise the customer’s time versus the firm’s time.

Erosion of relationship touchpoints by technology:

Technologies can eliminate in person steps which reduces opportunities for trust building. Firms are being forced to deliberately design interactions to maintain relationship quality.

- DocuSign removes physical signing visits, which were previously touchpoints.

- Fewer touchpoints challenge trust formation and the human face of interaction.

- Professional relationships rely on intentional contact design to preserve the relationship and trust.

Generational differences: Generation Z expectations and behaviours:

- Gen Z adopts online delivery readily and values speed and responsiveness.

- Preference for informal interactions over ‘stuffy’ professionalism, focusing on whether the firm can help them achieve their goals quickly.

- Self-reliance and an experimental approach to technology (“press the button, let’s give this a go”).

- Older generations exhibit less trust in internet information compared to Gen Z, who are more willing to believe and trust online sources, even from non-professionals.

Digital impact on customer behaviour and loyalty:

- Continuous monitoring of digital’s effect on market behaviour is required.

- Loyalty maintenance needs new approaches in digital contexts (speed, UX, ongoing engagement).

- Responsiveness becomes a core expectation shaped by consumer platforms.

Balancing technology and human personalisation:

- Use customer journey mapping to identify where technology can take over a slice of the journey and where opportunities to interact directly with the customer should be retained.

- Define communication messages per journey stage, dictated by interaction points.

- Let client preferences dictate touchpoint design (human vs. digital), starting with “what the client wants.”

It is not all doom and gloom but Dr Susan Rose finished by suggesting professional service firms should:

- Provide quick, snappy summaries alongside deep, comprehensive detail.

- Design information architecture that allows progressive disclosure.

- Acknowledge the current environment as a transition phase across generations, requiring strategies to cover a broad spectrum of expectations.

/Passle/53d0c8edb00e7e0540c9b34b/MediaLibrary/Images/2025-06-24-15-50-59-531-685ac963d81bf11b7522dd8e.png)

/Passle/53d0c8edb00e7e0540c9b34b/SearchServiceImages/2026-03-06-17-25-08-513-69ab0df49855a8beba72b8b5.jpg)

/Passle/53d0c8edb00e7e0540c9b34b/MediaLibrary/Images/2026-03-05-11-30-48-898-69a969685567110542b7721a.jpg)

/Passle/53d0c8edb00e7e0540c9b34b/MediaLibrary/Images/2026-03-04-13-03-49-406-69a82db53b412c54be32023c.jpg)

/Passle/53d0c8edb00e7e0540c9b34b/MediaLibrary/Images/2026-03-03-12-49-07-613-69a6d8c3734044ba8e9a01b0.png)